Since it can be difficult for traders to arbitrage differences, it allows for prices in markets to persist for longer than they would in a more efficient market. However, transferring money or assets across exchanges can be inefficient as more often than not, bots typically pounce on any arbitrage possibilities before traders can, or the exchange fixes the price before you’ve had a chance to sell. So, you buy the Bitcoin at a lower price, withdraw it, and aim to sell it at a higher price on the other exchange. For example, let’s say you have noticed Bitcoin has a lower price on one exchange compared to another. 3) ArbitrageĪrbitrage refers to the simultaneous purchase and sale of an asset to gain profit from an imbalance in price.

If a token or an exchange gains a bad reputation in the media it can prompt traders to cash out before the price plummets and they lose more money. This then spurs traders to start avidly buying that token, which drives the price up. In particular, if a cryptocurrency gains mainstream attention, there could be a sudden surge in popularity. Whilst there are factors that stem directly from the markets that affect the pricing of assets, the media can also influence them. So, remember that if liquidity is down, the prices will be changing. This in turn affects the price of cryptocurrencies as trading volume goes down in tandem. If liquidity is low overall, the order book will be less stacked.

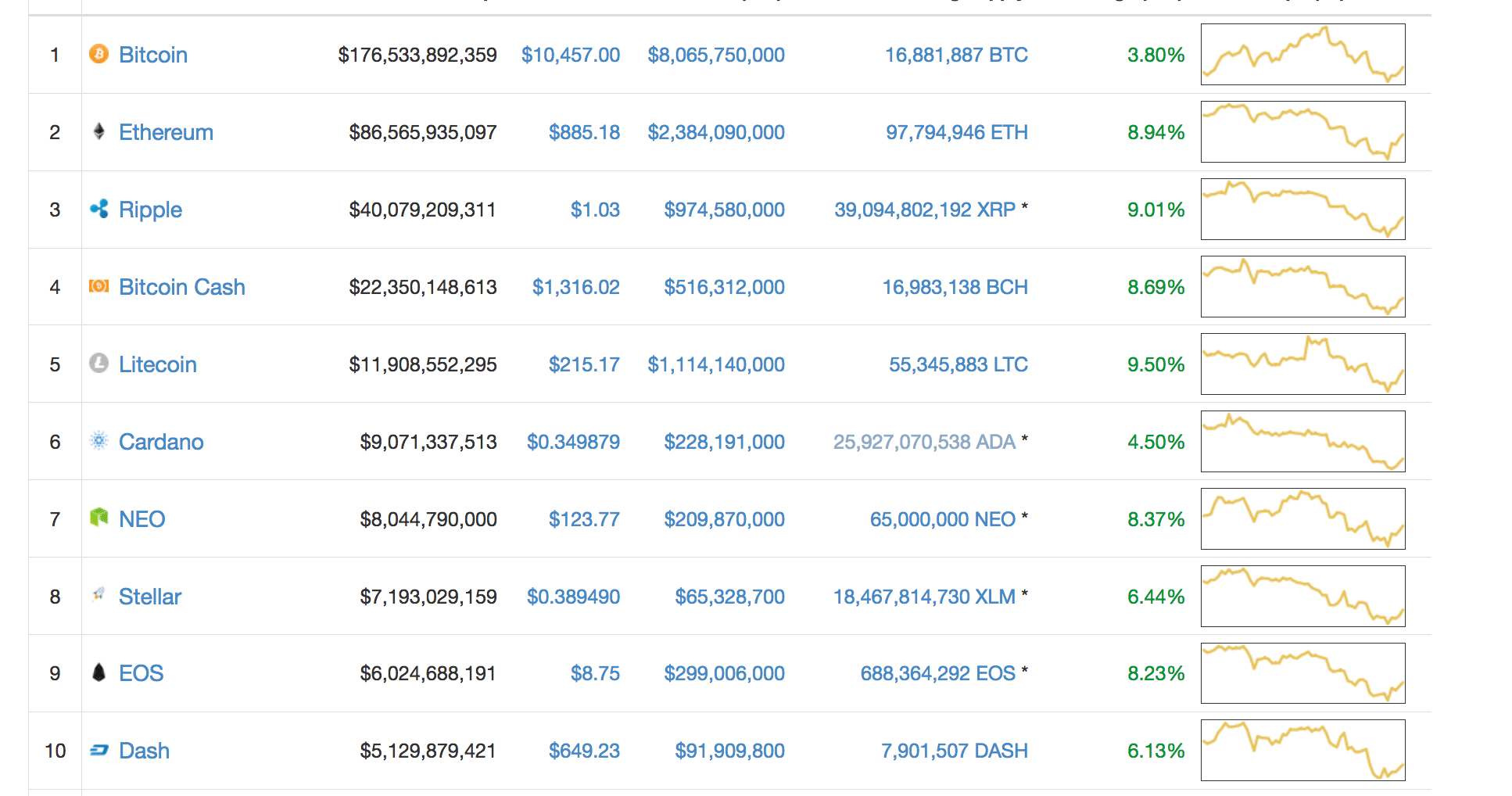

Each of these traders will be buying and selling at prices they are speculating, resulting in price movements up and down at all hours of the day. This is because the cryptocurrency trading market is open 24/7. As you can imagine, there are a lot of trades occurring at every moment. An order book is a collection of live trading that occurs when a trader sets a price that they will buy/sell an asset at. Whilst the Bitcoin price isn’t drastically different across these exchanges, there are slight variations.īe sure to look out for the order book on each exchange. If you look at different exchanges, you will see that each one has a different trading volume for Bitcoin. Since there is a person selling for every one person buying, you can think of trading volume as half of the number of transactions made in a day. Trading volume refers to the number of shares (or units of crypto) transacted every day. Trading volume is one aspect that affects liquidity pricing. However, the amount you will receive for liquidating an asset will largely depend on the market and exchange. In the world of crypto, liquidating an asset means trading it for fiat currency (a national currency).

Liquidity refers to the availability of liquid assets to a market or company. Let’s take a look at three things that impact cryoptocurrency price. This will also be a factor in price listings since some may process faster than others. It’s also worth noting that different exchanges have different price algorithms. However, since it has to process all this data from exchanges, it isn’t always up-to-date. This is because it collates all the data from several exchanges to provide the most rounded price available. In this guide, we take a look at why they change and why they are different depending on the exchange you are using.īefore we begin, it is worth noting that if you are checking crypto prices on a site like CoinMarketCap, it will be different to an actual exchange. Cryptocurrency price is volatile, and the prices change all the time.

0 kommentar(er)

0 kommentar(er)